CAPM

CAPM says that because non-systematic risk can be eliminated by diversification, it is not rewarded. It is the sensitivity of the security to the market (it’s beta) that is the appropriate measure of risk.

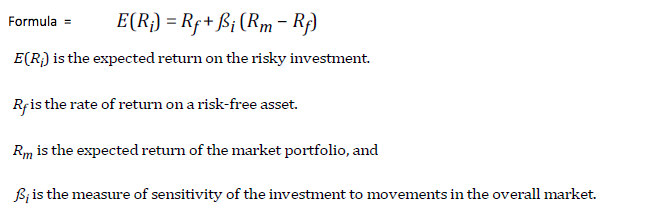

The CAPM is a model that derives the theoretical expected return for a security as a combination of the return on a risk-free asset and the compensation for holding a risky asset.

Limitations of CAPM

Risk Free Rate

- What to use at the risk free rate? – There is no set risk free rate, but we commonly use a 3 month Government T-Bill

Market Portfolio

- What to use as the market portfolio? – It assumes all worldwide investments, but we commonly use a market index such as FTSE100 or FTSE All Share

Beta

- This must be stable however it is calculated from past data and may not be a reliable estimate of future risk. Some US studies have proved that there isn’t a relationship between excess return and it’s beta.

However over longer periods of time the theory does hold true.

Questions - Use Your Note Taker To Jot Down Ideas / Calculations

1. Two of the variables needed to calculate the expected return of a risky asset using the Capital Asset

Pricing Model are:

a) beta and the risk free rate of return.

b) standard deviation and the risk free rate of return.

c) beta and variance.

d) beta and standard deviation.

A)

This is simply a case of knowing the CAPM formula = Risk free rate + beta X (Market return – Risk

free rate). From the formula it is clear than both the beta and risk free rate of return are needed to

calculate CAPM.

2. The Prime Growth Fund has a standard deviation of 12 and a beta of 1.6. The return on treasury bills

is 2% and the return on the market is 8%. What is the expected return under the Capital Asset

Pricing model?

a) 11.6%.

b) 12%.

c) 6.1%.

d) 0.80%.

A)

To calculate CAPM use the CAPM formula. First subtract the risk free rate (2%) from the return on

the market (8%). Next multiply this by beta (1.6) – this gives you 9.6. Finally add the value of the risk

free rate to this figure which will bring you to 11.6%. The total calculation would be 2% + 1.6 (8%-

2%).

- Further Study Text: Pages 141 - 144