Money-Weighted Rate of Return

The Holding Period Return (HPR) demonstrates the money returns in terms of the amount of value of the portfolio at the start of the period.

The Holding Period Return (HPR) demonstrates the money returns in terms of the amount of value of the portfolio at the start of the period.

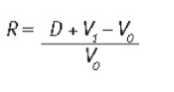

R = Rate of return

D = Distributions (income paid to investor during stated period)

V1 = Value of the portfolio at the end of the period

V0 = Value of the portfolio at the beginning of the period.

The Money Weighted Rate of Return (MWR) measures overall return over a given time period. The MWR is a modified version of the holding period return formula which takes into account the timing of capital additions or withdrawals.

C = cash flow (money introduced or withdrawn during the period) – important to note that Income withdrawn (D) is not treated as Cashflow (C)

n = number of months remaining in the year

Example:

A client invests £30,000 at the start of the year and by the end of the year this sum is worth £36,000. During this period £4,000 was invested in March and £2,500 was withdrawn during June. Calculate the MWR.

-First we need the value of the portfolio at the start and end of the period:

-Now we need the value of any distributions or cash flow:

-We then place these figures into the formula:

-We split up each element of the cash flow in the denominator in order to multiply it by its relevant time frame (9 months remaining for investment, 6 months remaining for withdrawal).

-The MWR is 14.17 % (2d.p). This is the overall return achieved on the portfolio at the end of the year.

Questions - Use Your Note Taker To Jot Down Ideas / Calculations

The questions in the exam will look at the characteristics of MWR and the comparison between MWR

and TWR, you will not need to work through a calculation. However, it is important to fully

understand the formula.

1. In order to calculate the money-weighted return (MWR) for an investment, it is important to take

account of:

a) the percentage held in risk-free assets.

b) the tax status of the investor.

c) any income or withdrawals.

d) the risk-free rate of return.

C)

The MWR does not take into account risk or tax status but just measures pure return. The income

and withdrawals to a portfolio are taken into account when calculating both MWR and TWR.

- Further Study Text: Pages 397 - 399