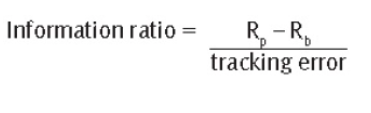

Information Ratio

Information ratio: measures the risk-adjusted performance of active portfolio managers.

RP = portfolio return

Rb = benchmark return

Tracking error = the standard deviation (volatility from the mean) of the relative returns

Example:

An investment portfolio has an annualised return of 12%. Average market return is 10% during the same period and the investment has a tracking error of 5%. Calculate the Information Ratio.

-First we know the values for the rates of return and tracking error:

-We then place these figures into the formula:

-Therefore, Information Ratio is 0.4. This indicates the risk-adjusted return on this investment and the value added by the manager through active investment. This figure is often used as a comparison between different portfolio managers.

Questions - Use Your Note Taker To Jot Down Ideas / Calculations

1. An investment portfolio has an annualised return of 8%. Average market return is 6% during the

same period and the investment has a tracking error of 4%. Calculate the Information Ratio.

a) 0.7

b) 0.2

c) 2.4

d) 0.5

D)

To answer this question use the information ratio formula.

(8% – 6%)/4% = 0.5

An information ratio of 0.5 indicates the risk-adjusted return on this investment and the value added by the manager through active investment.

- Further Study Text: Pages 405 - 406