- Intro to life assurance based investments

- With profits policies

- With profits policies – market value reduction

- Unitised vs. Conventional With Profits Policies

- Advantages and Disadvantages of With Profits Policies

- Pound Cost Averaging

- Early Encashment of Life Assurance Policies

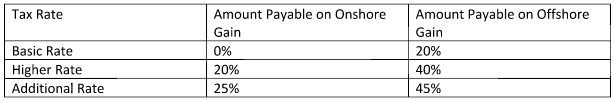

- Taxation of Life Assurance Policies

- Second Hand Life Assurance Policies

- Friendly Society Policies

Onshore vs. Offshore Bonds

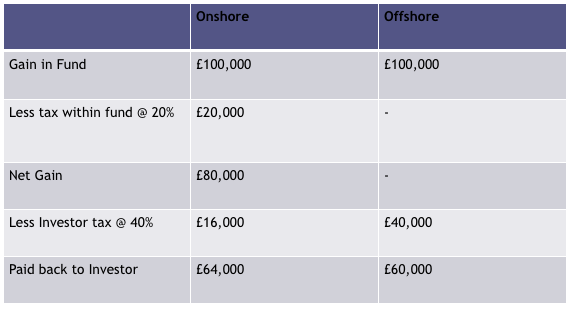

Onshore bonds have 20% tax deducted within the bond, whereas offshore bonds do not have any tax deducted. Therefore, it may seem that the offshore bond is always preferable. This is not necessarily true for a number of reasons –

- Charges on offshore bonds are generally higher than onshore bonds, which will reduce the final net payment received by an investor.

- In an onshore fund, management expenses may be deductible from the fund’s income for tax purposes. An offshore fund has no tax from which to deduct management expenses, thus reducing the effect of the gross roll-up.

- On an onshore bond, for a higher-rate taxpayer 20% tax is charged on the net return of the fund, whereas on an offshore fund the 40% is on the gross return. This can lead to better returns from the onshore bond.

- One advantage of an offshore bond is that income can roll up gross. In theory, over the long term, the compounding effect could make a difference to the eventual overall return, despite the higher tax on final encashment. However, this advantage is generally only gained over the long-term or where the fund is invested in interest bearing assets.

The below table shows how an onshore bond can sometimes be better for an investor – it contrasts an onshore and an offshore bond each with an £100,000 gain for a higher rate(40%) tax payer.

Questions - Use Your Note Taker To Jot Down Ideas / Calculations

1. Sally is a higher rate taxpayer earning £66,000 and her husband Chris is a basic rate taxpayer earning

£19,000. They both have cashed in offshore bonds and made gains of £10,000 each. How much is

their combined Income Tax liability?

a) £2,000.

b) £4,000.

c) £6,000.

d) £8,000.

C)

Offshore bond gains are charged at the investors marginal rate of income tax. So Sally as a higher

rate tax payer will pay 40% on the £10,000 (£4,000) and Chris as a basic rate tax payer will pay 20%

on the £10,000 (£2,000) – total tax liability = £6,000

2. Fred is an additional rate tax payer. He enchases an onshore bond with a gain of £20,000. What is his

tax liability?

a) £5,000

b) £9,000

c) £4,000

d) £2,000

A)

Both onshore and offshore bonds are taxed at income tax rates. However, as 20% is already paid

within the fund for onshore bonds, there is only 25% of the additional rate of income tax (45%)

remaining to be paid. 25% of £20,000 is £5,000.

3. Jacquie, an additional rate taxpayer, invested £80,000 in an onshore investment bond. After six and

a half years she makes her first withdrawal of £30,000. The income tax liability as a result of this

withdrawal will be:

a) £1,500.

b) £500.

c) £3,000.

d) £1,000.

B)

Jacquie has held the bond for 6.5 years with no withdrawals meaning she has 7 years worth of the

5% tax deferred allowance unused – the 5% allowance is available from the start of the year in

question.

The 5% allowance each year is £4,000 (5% of £80,000). This is multiplied by 7 as there is 7 years of

tax deferred allowance available = £28,000. The tax on this £28,000 is deferred. The remaining

£2,000 from the £30,000 withdrawal is taxable.

Jacquie is an additional rate tax payer. As the bond is onshore 20% has already been paid within the

bond – this leaves a 25% tax liability. The chargeable amount is £2,000 therefore meaning there is a

tax charge of £500.

- Further study text reading: Pages 267 - 268