Return to Solo 1 (RO4) course

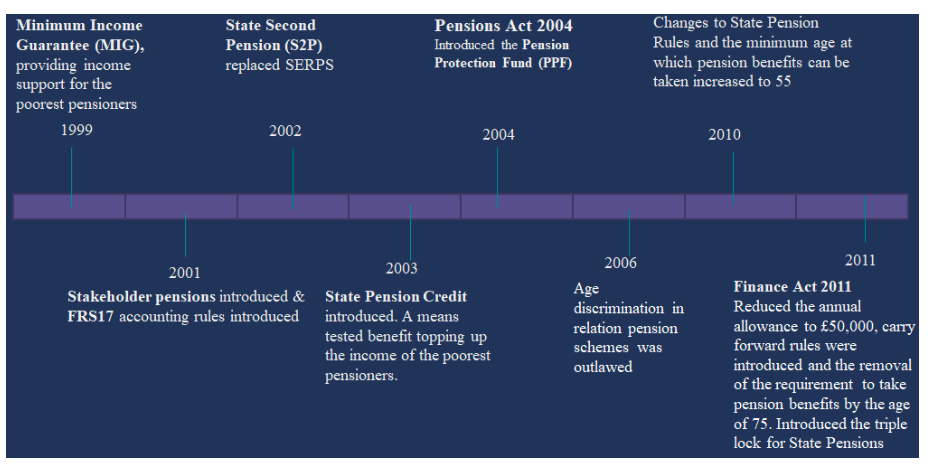

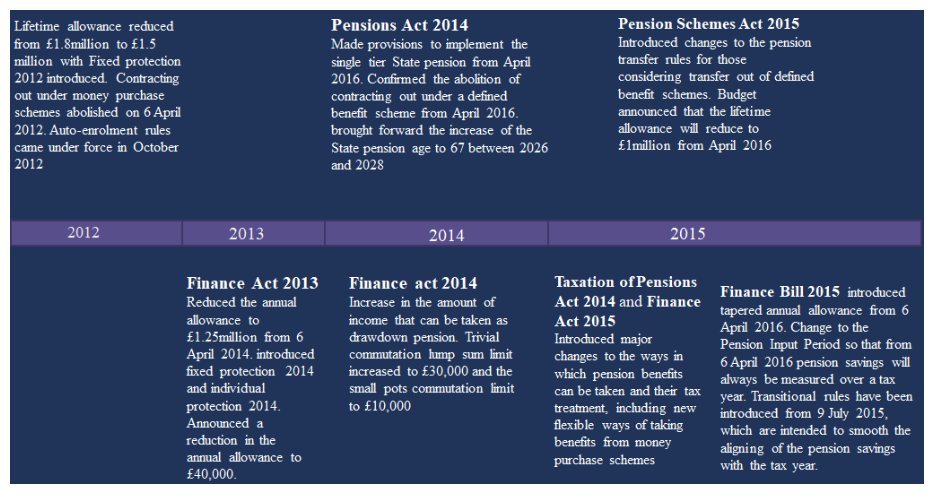

Timeline of events

Main recent changes the government have made to the pension industry.

- Overhaul of state pensions – before April 2016 the state pension was made up of a basic state pension and a number of additional state pensions. In April 2016 all previous State Pensions were replaced by a single-tier State Pension. You need 35 years of NICs payments to receive the full state pension.

- Increase in the state pension age – before 2010 it was 60 for women and 65 for men. Since then women’s SPA has been increasing to 65. Additional legislation has been introduced to increase the age for both men and women to 67 by 2028.

- Encouraging private pension provision – Auto enrolment introduced in October 2012, all eligible workers who do not have access to an adequate workplace pension scheme must be automatically enrolled into a scheme with a required minimum level of contribution.

- Single pension tax regime introduced – 6 April 2006 (A day) single pension tax regime introduced, replaced all existing. Introduced annual allowance & life time allowance.

- The Money Purchase Annual Allowance (MPAA) was introduced by the Taxation of Pensions Act 2014, on 6 April 2015. The Money Purchase Annual Allowance was:

– £10,000 for tax years 2015/16 and 2016/17; and

– £4,000 for tax year 2017/18 and to date

Question - Use Your Note Taker To Jot Down Ideas / Calculations

The Government initiative that has had the GREATEST impact on increasing the level of private pension saving in the UK over recent years is the:

a) removal of the age allowance.

b) introduction of auto-enrolment.

c) equalisation and increase of the State Pension Age for both men and women.

d) introduction of the new State Pension

B)

Introduction of auto-enrolment.