- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Carry Forward

Carry forward is the ability to use up any unused allowances from the previous 3 tax years once the allowance in the current tax year has been fully utilised.

These rules can be used for people to cover themselves in the event of a one-off spike in contributions, for example a pay rise for a DB pension member.

To use carry forward you must also have been a member of a registered pension scheme at some point in the earlier tax year. It doesn’t mean you have to have had put in any contributions in the tax year to be a member.

- an active member;

- a pensioner member;

- a deferred member; or

- a pension credit

If you are using carry forward you must have the UK relevant earning to be able to claim tax relief in the tax year you are making the contribution.

For an individual using carry forward in the 2018/19 tax year, we would look back through the 2017/18, 2016/17 and 2015/16 tax years. This clearly goes through the year when the PIP changed but for the R04 exam you do not need to be able to calculate the pension input in the pre and post alignment tax years, you will be given the input figures for the pre and post alignment tax years.

A carry forward exercise involves the following steps:

- the annual allowance for the current year is always used up first, so a carry forward exercise in 2018/19 is only necessary if the current tax year’s pension input is to be in excess of £40,000 (or the tapered annual allowance where this applies);

- a carry forward exercise then begins by using up any unused annual allowance from the earliest carry forward year first (i.e. for a carry forward exercise in 2018/19 the unused annual allowance from 2015/16 is used up first);

- for 2015/16 the calculation is based on the rules outlined earlier in this section, i.e. it will be necessary to work out any unused annual allowance remaining in the pre-alignment tax year, subject to a maximum carry forward of £40,000 less any amount used in the post-alignment tax year; and

- for the 2016/17 and 2017/18 PIPs the unused annual allowance is calculated by deducting the pension input from £40,000 (or the tapered annual allowance).

EG – Calculation for the pre and post alignment tax year.

In 2015/16 Jason’s pension input into his personal pension was as follows:

- £55,000 in the pre-alignment tax year; and

- £20,000 in the post-alignment tax

The annual allowance in the pre-alignment tax year was £80,000:

- of this amount £55,000 was utilised in the pre-alignment tax-year, so potentially

£25,000 is available to carry forward;

- however, the maximum that can be carried forward is the unused annual allowance remaining in the pre-alignment tax year (£25,000 in this example), less the pension input in the post-alignment tax year (£20,000 in this example);

- this means that Jason is able to carry forward £25,000 – £20,000 = £5,000 from 2015/16.

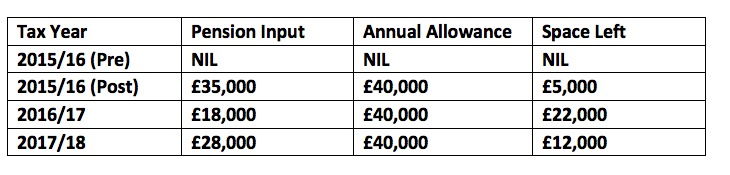

EG – Jeremy has relevant UK earnings of £92,000 for 2018/19 and this is his only income. Jeremy is not subject to the tapered annual allowance in 2018/19, nor was he in previous tax years. In recent tax years, Jeremy has made the following contributes to a SIPP:

In this case Jeremy did not make any pension contributions in the pre-alignment tax year. As a result, there was no pension input to measure against the increased annual allowance of £80,000 for the pre-alignment tax year. Instead his contribution of £35,000 in the post-alignment tax year was measured against an annual allowance of £40,000.

The amount of unused annual allowance that Jeremy can carry forward to 2018/19 is calculated as follows:

- In 2015/16 the unused annual allowance is £40,000 – £35,000 = £5,000.

- In 2016/17 the unused annual allowance is £40,000 – £18,000 = £22,000.

- In 2017/18 the unused annual allowance is £40,000 – £28,000 = £12,000.

Overall the total unused annual allowance that can be carried forward to 2018/19 is:

£5,000 + £22,000 + £12,000 = £39,000.

Jeremy has not yet made any contributions in 2018/19 and on 1 September 2018 he decides that he would like to make a contribution of £70,000. He has an annual allowance of £40,000 for 2018/19. This will utilise his annual allowance as follows:

- he must utilise the annual allowance of £40,000 from 2018/19 first;

- this leaves £30,000 to be carried forward from the previous three tax years, starting from 2015/16;

- £5,000 is carried forward from 2015/16 first, leaving a further £25,000 to be carried forward;

- £22,000 is carried forward from 2016/17, leaving a further £3,000 to be carried forward; and

- the remaining £3,000 is carried forward from 2017/18 leaving £9,000 of unused annual allowance to be used in 2019/20 or 2020/21. If it is not used by 2020/21 this unused annual allowance will be lost, as it can only be carried forward for a maximum of three years.

Pension input in excess of the annual allowance in one or more of the previous tax years. Where pension input in one or more of the previous three tax years was in excess of the annual allowance for that year, it will be necessary to look back a further three years from the year in question to see what unused relief was available.

Question - Use Your Note Taker To Jot Down Ideas / Calculations

In 2015/16 Sam’s pension input into his personal pension was as follows:

- £5,000 in the pre-alignment tax year; and

- £25,000 in the post-alignment tax year.

What is the maximum amount that Sam can carry forward from 2015/16?

a) £50,000.

b) £35,000.

c) £15,000.

d) £10,000.

C)

The annual allowance in the pre-alignment tax year was £80,000. Of this amount only £5,000 was utilised in the pre-alignment tax year, so potentially £40,000 is available for carry forward. However, the maximum that can be carried forward is £40,000 less the pension input of £25,000 in the post-alignment tax year. Hence Sam is able to carry forward £40,000 – £25,000 = £15,000 from 2015/16.