- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Return to Solo 2 (RO4) course

MPAA triggered with contributions

MPAA is triggered and subsequent pension input into a money purchase scheme is less than or equal to £4,000

- The annual allowance is £40,000 in the tax year and it is possible to use carry forward but only for DB pension input

- Any unused money purchase annual allowance cannot be carried forward

MPAA is triggered and subsequent pension input into a money purchase scheme is greater than £4,000

- As well as their MPAA, a member who has flexibly accessed their pension savings also has an alternative annual allowance. This can only be used for pension input in respect of DB pension input

- The annual allowance for money purchase schemes is £4,000

- The annual allowance for the tax year with respect to any DB schemes if £36,000 also known as the alternative annual allowance, ie it is annual allowance minus £4,000.

- It is possible to use carry forward to increase the alternative annual allowance

- It is not possible to use carry forward to increase the MPAA

- Any pension savings tested against the MPAA are not tested against the alternative annual allowance

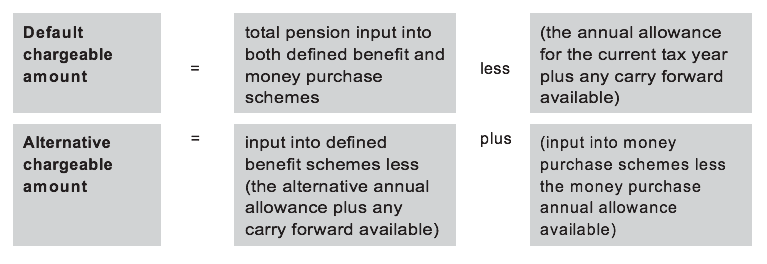

If the input into a DC pension exceeds the MPAA, we must establish the chargeable amount which is the higher of the default chargeable amount or the alternative chargeable amount.