- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

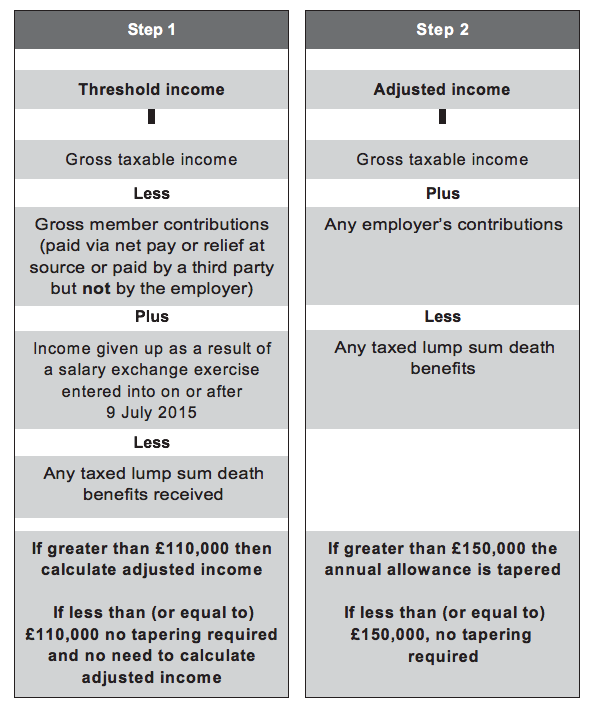

Tapered Annual Allowance

On 6 April 2016 mean that for those with adjusted income (which includes their own and their employer’s pension contributions) above £150,000, the £40,000 annual allowance reduces on a tapered basis.

To ensure that this measure is focused on these high earners, those with threshold income (excluding pension contributions) of £110,000 or less are not subject to the tapered annual allowance.

When calculating the threshold and adjusted income the starting point is the same. Net income is gross taxable income from all sources less allowable deductions.

An individual’s gross taxable income could include any of the following:

- earnings from employment;

- earnings from self-employment or partnerships;

- most pension income (i.e. State Pensions, scheme pensions, lifetime annuity, income drawn from a drawdown plan, UFPLS payments etc);

- interest on most savings;

- dividend income;

- rental income; and

- income received from a trust

Tapered annual allowance is calculated as follows:

EG – In 2018/19 Jane, aged 48, receives a salary of £114,000 from her employer. She also has gross savings interest of £1,000 and gross dividend income of £35,000. Jane is a member of her employer’s occupational money purchase pension scheme and contributions are paid via the net pay arrangement. In 2018/19 Jane contributes £15,000 gross to this scheme and her employer contributes £10,000.

Jane’s gross taxable income is calculated as £114,000 salary + £1,000 savings interest + £35,000 dividend income = £150,000.

Jane’s threshold income will be £150,000 less her £15,000 employee pension contribution = £135,000. As her threshold income is above £110,000 we move on to calculate her adjusted income.

Jane’s adjusted income is calculated as her gross taxable income of £150,000 + her employer’s contribution of £10,000 = £160,000.

As a result, her annual allowance is reduced by (£160,000 – £150,000) ÷ 2 = £5,000 for 2018/19, leaving her with an annual allowance of £35,000.

Question - Use Your Note Taker To Jot Down Ideas / Calculations

In 2018/19 Gavin receives a salary of £125,000 and also has gross dividend income of £20,000. His employer contributes £15,000 into his personal pension plan. What is Gavin’s annual allowance for 2018/19?

Select one:

a) £35,000.

b) £10,000.

c) £30,000.

d) £40,000.

A)

Gavin’s threshold income is above £110,000 so he must be tested for the adjusted income, to see if the annual allowance should be reduced. His adjusted income is all taxable income plus any employer pension contributions, therefore £125,000 + £20,000 + £15,000 = £160,000.

Therefore for every £2 over the threshold of £150,000 Gavin will lose £1 of this annual allowance. As he is £10,000 over the threshold he will lose £5,000 of his allowance, thus £40,000 – £5,000 = £35,000