- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Spreading table

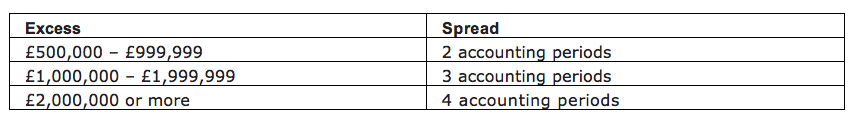

Where the spreading of tax relief is to apply to the excess, the following is used

EG – Last year, ABC plc made an annual contribution of £600,000 to its pension scheme. This year, it decided to boost the retirement benefits of three directors and the total pension contributions amounted to £1,900,000. The spreading calculation would be:

- 210% of previous chargeable period contribution = 210% × £600,000 = £1,260,000.

As the £1,900,000 contribution exceeds £1,260,000 the spreading table will apply if the excess is £500,000 or more.

- Excess over 110% of previous contribution = £1,900,000 – (£600,000 × 110%) = £1,240,000.

As this falls in the band of £1,000,000 – £1,999,999, the relief on this ‘excess’ contribution will be spread evenly over three accounting periods, i.e. £413,333 per period.

In the current period, relief will be given on 110% of the previous year’s contribution (i.e.

£660,000) plus the first of the three sums of £413,333, giving a total of £1,073,333.

Question - Use Your Note Taker To Jot Down Ideas / Calculations

Alpha Co Ltd have made pension payments of £300,000 in 2016/17 and 2017/18 but have increased this to £900,000 for 2018/19. Tax relief on the 2018/19 contribution will be:

Select one:

a) spread over four accounting periods.

b) spread over three accounting periods.

c) spread over two accounting periods.

d) fully available in the current accounting period.

C)

The new contribution is over 210% of the previous year’s contribution so we must calculate if the excess is above £500,000. Thus:

Excess over 110% of previous contribution = £900,000 – (£300,000 × 110%) = £570,000.

Relating back to the spreading table the excess is between £500,000 and £999,999 so 2 periods will apply.