- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Salary Sacrifice

Under a salary sacrifice agreement (sometimes referred to as salary exchange) an employee agrees to a reduction in their salary and in return the employer pays a pension contribution on the employee’s behalf of the sacrificed amount. The same can be done for bonus payments.

As a result both employee and employer will pay reduced NICs which some employers will put the extra savings into the pension scheme meaning a larger contribution can be paid in at no extra cost.

HMRC require certain conditions to be fulfilled for a salary sacrifice arrangement to be effective:

- There must be a written agreement in place between the employer and the employee to reduce the employee’s salary;

- The agreement must be in place before the salary is actually reduced;

- The reduction in salary cannot take the employee’s salary below the national minimum wage.

It is possible to swap back when a change in the employee’s circumstances are altered by a lifestyle change, such as marriage or divorce or pregnancy.

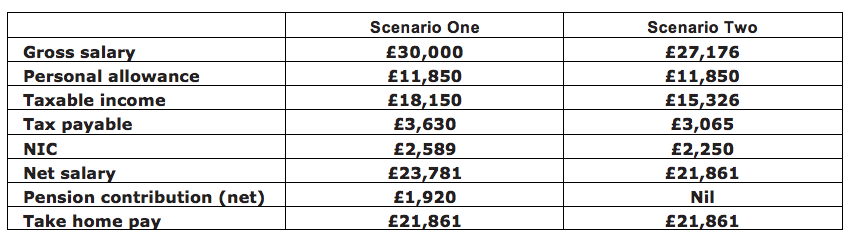

An example of how salary sacrifice works for scenario one with an income of £30,000 but in scenario two the employee uses salary sacrifice to keep the same take home pay but increase the amount going into the pension. As you can see their gross salary has been reduced by £2,824, which is higher than the gross pension contribution of £2,400 that the employee was paying in Scenario One.

The amount going into the pension could be enhanced further if the employer’s NIC saving of 13.8% (£2,824 × 13.8% = £390) is put into the pension.\

Disadvantages of salary sacrifice:

- salary is reduced for all purposes – This may mean reduced benefits such as death in service

- It may reduce the borrowing capacity for mortgages and other loans

- It may reduce or cause a full loss of social security benefits.