- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

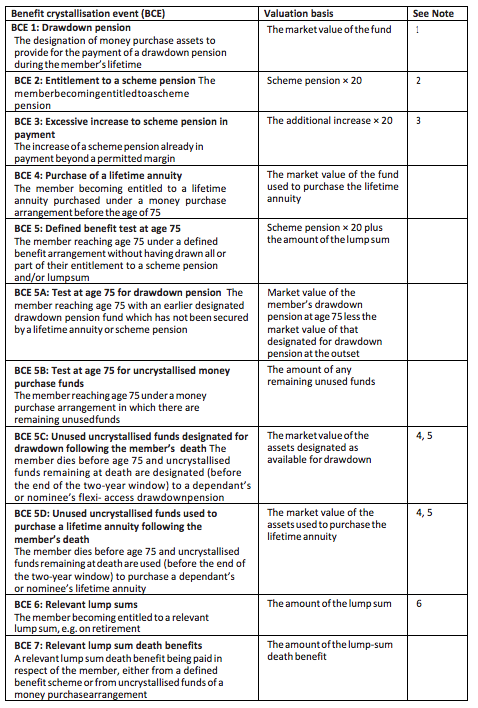

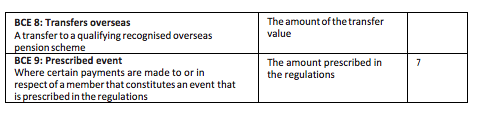

Benefit Crystallisation Events

When benefits from a registered pension scheme come into payment, whether in full or in part, the value of the pension savings must be tested against the lifetime allowance in force at that point, known as a Benefit Crystalisation Event (BCE)

Methods of taking an income from the pension:

- Scheme pension – money paid directly from a registered pension scheme

- Lifetime annuity

- Drawdown pension

- Uncrystallised funds pension lump sum (UFPLS)

There are 13 BCEs:

Notes

- This event would typically be the start of income

- The 20:1 factor (which equates to a 5% annuity rate) applies regardless of age and sex, g. £10,000 of pension is valued at £200,000. However, a different factor will apply if total survivors’ pensions exceed the member’s pension and/or pensions increase by more than the greater of 5% compound and the RPI. In such rare cases, a higher factor must be agreed with HMRC.

- The permitted margin is currently the initial pension level increased by the greater of the growth in RPI and 5% a year to the date of payment. This operates on a cumulative basis, so would normally only bite when total annual increases exceed the greater of the growth in RPI or 5% a year compound or any higher factor previously agreed with HMRC (see 2). Annual increases of not more than £250 are In addition, where the pension scheme has at least 50 pensioner members who are receiving a scheme pension, and the same rate of increase is being paid at the same time to everyone in a class of at least 20 pensioner members, the test is not triggered for an individual in that class.

- The Taxation of Pensions Act 2014 introduced a new type of beneficiary called a ‘nominee’. A nominee is any individual nominated by the member, other than a dependant, who is nominated to receive the benefits from the member’s pension plan upon the member’s

- The ‘two-year window’ is the timeframe within which death benefits must be ‘designated’ to an income producing contract, or paid out as a lump sum in the case of a lump-sum death The two-year window starts from the date the scheme administrator is notified of the death or, if earlier, the date the scheme administrator could reasonably be expected to know of the death.

- Relevant lump sums are PCLS, an UFPLS, a serious ill-health lump sum and a lifetime allowance excess lump

- This BCE applies a lifetime allowance test when payments are made which would be unauthorised, were it not for regulations made under 164(1)(f) of the Finance Act 2004. The relevant regulations are The Registered Pension Schemes (Authorised Payments) Regulations 2009 (SI 2009/1171). They cover certain pension and PCLS payment errors.

Question - Use Your Note Taker To Jot Down Ideas / Calculations

Lewis retired on 1 June 2006 and took the benefits from his defined benefit scheme. He received a pension commencement lump sum of £150,000 plus a scheme pension of £50,000 p.a. What percentage of Lewis’ lifetime allowance was used in June 2006?

Select one:

a) 83.33%.

b) 76.66%.

c) 23.33%.

d) 93.33%.

B)

The calculation is 20 times the value of the income plus the value of the PCLS. Therefore (20 x £50,000) + £150,000 = £1,150,000.

The LTA in 2006/07 was £1.5m therefore the LTA useage = £1,150,000/£1,500,000 = 76.66%