- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Divorce Post April 2006

In this scenario the lifetime allowance of the ex-spouse may be enhanced to reflect the fact

that the member’s pension came into payment on or after 6 April 2006 and would have been tested against the original member’s lifetime allowance at that time.

The factor is called the pension credit factor.

It old applies when the pension came into payment after 5th April 2006.

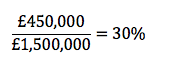

The enhancement for the ex-spouse is so that the pension credit is not tested again against the LTA when the ex-spouse crystallises the credit. For example if the credit was worth £450,000 at the LTA was £1.5m at the time:

This factor is then applied to the standard lifetime allowance at any future BCE. However, if the pension credit factor was generated before 6 April 2012 slightly different rules apply, whereby:

- the uplift is provided by applying the factor to the figure of £1.8 million, if this is more than the standard lifetime allowance; and

- this uplift is then added to the standard lifetime allowance at the date of the BCE to arrive at the individual’s lifetime

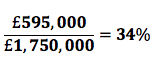

EG – Melissa was divorced in June 2009 and she got £595,000 as a pension credit, with the LTA being £1.75m in 2009/10.

The enhancement factor will be:

In May 2018 Melissa decides to crystallise her own pension benefits. Her personal lifetime allowance, taking into account the pension credit, is calculated as:

- Standard lifetime allowance + (£1.8 million × 0.34).

- Which gives her a personal lifetime allowance of: £1.03 million + (£1.8 million × 0.34) = £1,642,000.