- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Return to Solo 2 (RO4) course

Pre A Day benefits

A different calculation is used when benefits were already in payment before 6th April 2006

A standard 25:1 valuation factor is used for pre-A-Day income benefits from a DB pension or annuity.

Income from a drawdown pension is more complicated.

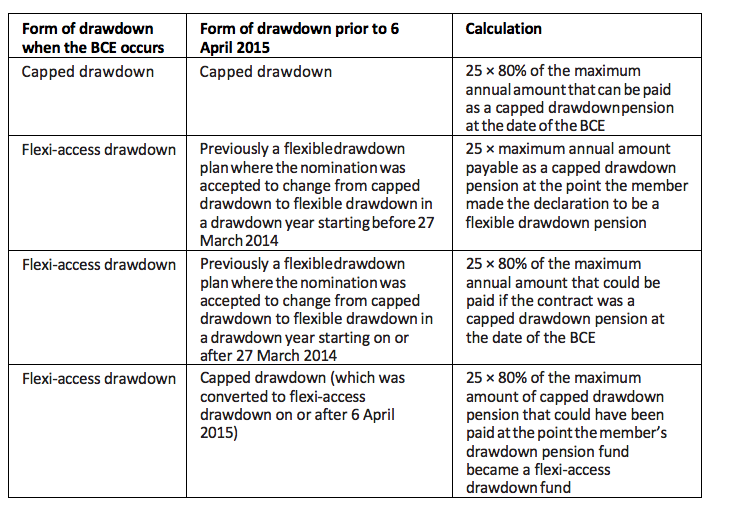

The calculation that is carried out is determined by the form of the drawdown fund when the BCE occurs

Remember: this only applies where the drawdown pension was in payment prior to 6 April 2006 and the first BCE has occurred on or after 6 April 2015.

Note: the ‘maximum annual amount’ referred to here is equal to the basis amount × 150%. Therefore it’s 150% x 80% = 120%