- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Annuity

If the member dies after securing benefits there will only be a lump sum if the member included a protected capital lump sum.

From a scheme pension from a DB scheme this is called a pension protection lump sum death benefit

From a scheme pension or lifetime annuity from a money purchase scheme this is called an annuity protection lump sum death benefit.

The maximum amount payable is equal to the amount crystalised to provide the income:

- For a money purchase scheme this is the fund that has been crystalised, or

- For a DB scheme it is 20 times the initial pension income, but

- LESS the value of gross income payments already received.

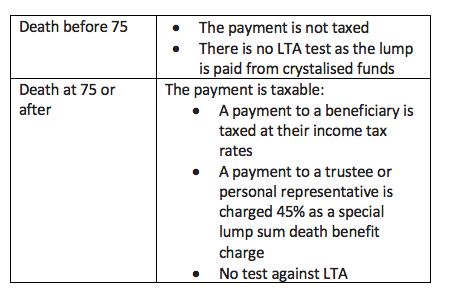

Tax position of these payments from 6th April 2016

Yolanda, aged 76, used £250,000 of funds she had previously held in a capped drawdown fund to purchase a lifetime annuity in 2014. She included annuity protection of 50% of the purchase price.

At the time of Yolanda’s death in May 2018 she had received gross annuity payments of

£49,000. Yolanda had nominated her niece, Hermione, aged 51, to receive the benefits under her annuity protection. The scheme administrators paid the lump sum to Hermione in July 2018.

The death benefits payable will be calculated as:

- Annuity protection purchased = £250,000 purchase price × 50% annuity protection = £125,000.

- Funds ‘unused’ at date of death are £125,000 – £49,000 = £76,000.

As Yolanda died after age 75 and the payment was made after 6 April 2016, the annuity protection lump sum death benefit of £76,000 is taxable as Hermione’s pension income via PAYE.