- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Return to Solo 2 (RO4) course

Defined Benefit Scheme

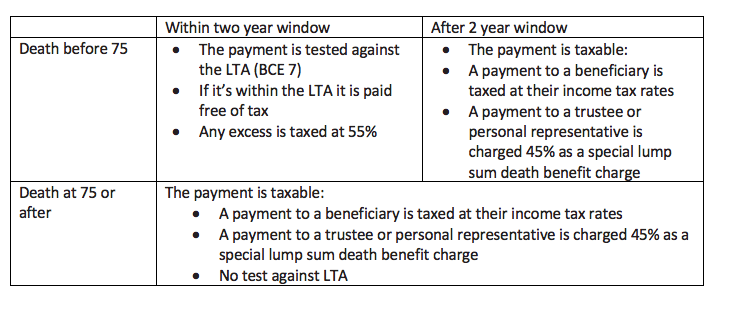

Tax position of these payments from 6th April 2016