- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Uncrystalised or unused funds

When paid from uncrystalised or unused funds, there is no restriction as to who it can be paid to.

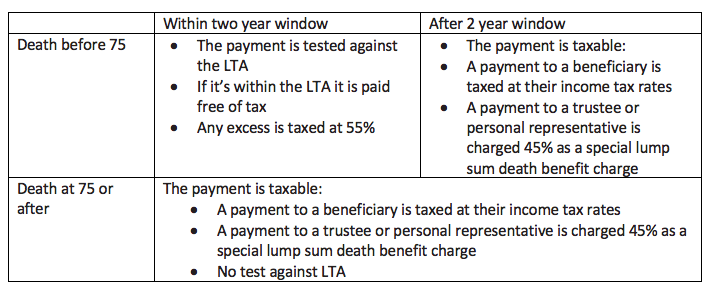

Tax position of these payments from 6th April 2016

EG – On 1 May 2018 Julianne died aged 59. She has no form of transitional protection and has not previously crystallised any pension benefits. Julianne nominated her son, Robert, to receive her money purchase pension benefits. Robert, who was aged 31 when his mother died, does not meet the criteria to be considered a dependent under HMRC rules.

At the date of Julianne’s death her pension funds were valued at £1,100,000. Robert advises the scheme administrator that he wishes the funds to be paid as a lump-sum death benefit. As the funds exceed Julianne’s lifetime allowance by £70,000 (i.e. £1,100,000 – standard lifetime allowance for 2018/19 of £1,030,000 = £70,000) there will be a lifetime allowance excess lump-sum tax charge of £70,000 × 55% = £38,500.

The funds were then paid to Robert on 1 July 2018. The amount he receives is the fund less the lifetime allowance excess lump sum tax charge, i.e. £1,100,000 – £38,500 = £1,061,500.

This is because his mother was aged under 75 when she died and the funds were paid to him within the two-year window.

Question - Use Your Note Taker To Jot Down Ideas / Calculations

Question for Chapter 2.2 – Section 8 – Part 2

Marcus died in August 2018 at the age of 76. The nominated beneficiary for his unused personal pension fund is his daughter Sally, who takes the entire fund as a lump sum in November 2018. In respect of the tax treatment of the death benefits it is TRUE to say that the lump sum will be:

Select one:

a) paid free of tax and there will be no test against Marcus’ remaining lifetime allowance.

b) taxable as Sally’s pension income via PAYE and there will be no test against Marcus’ remaining lifetime allowance.

c) paid free of tax, but the value of the unused funds will be tested against Marcus’ remaining lifetime allowance.

d) taxable as Sally’s pension income via PAYE and the value of the unused funds will be tested against Marcus’ remaining lifetime allowance.

B)

The income is taxable as Sally’s pension income via PAYE as Marcus died after 75 years old and there will be no test against Marcus’ remaining lifetime allowance as Marcus had a test at age 75.