- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Return to Solo 2 (RO4) course

Temporary non residence

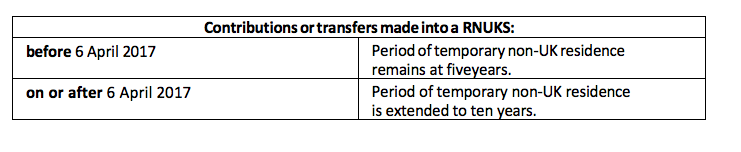

Specific rules apply to those who take benefits from a RNUKS during a period of temporary non-UK residence

Where such an individual takes benefits from a RNUKS during their period of non-residence, the pension received is only taxed in the UK upon the member’s return if the relevant withdrawals taken during that time, from both registered pension schemes and RNUKS, total more than £100,000. This excludes tax free payments.

Relevant withdrawals from a RNUKS are payments, which if made from a registered pension scheme, would be:

- income withdrawals or short-term annuity payments from the member’s flexi-access drawdown fund;

- withdrawals from a drawdown fund where the member was entitled to a flexible drawdown pension before 6 April 2015;

- withdrawals from a dependant’s drawdown fund where the dependant was entitled to a flexible drawdown pension before 6 April 2015;

- a lifetime annuity, which the member became entitled to on or after 6 April 2015, and where the annuity payments could go down by more than the prescribed amount;

- a dependant’s lifetime annuity, which the dependant became entitled to on or after 6 April 2015, and where the annuity payments could go down by more than the prescribed amount; and

- a scheme pension paid directly from the fund of a money purchase arrangement, which the member became entitled to on or after 6 April 2015, where there are fewer than eleven other members (including dependants) receiving a scheme

- A payment liable to tax, but where tax is not payable due to the operation of a double taxation agreement, is also a relevant withdrawal