- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Individual Protection 2014

Introduced when the LTA reduced to £1.25m on 6th April 2014 for people who didn’t have primary or enhanced protection and had pension benefits worth more than £1.25m

It gives members a protected LTA equal to the value of their benefits on 5th April 2015, up to £1.4m

Must apply before 5th April 2017.

The biggest difference was that members were still able to accrue benefits within their pensions.

This protected benefits up to £1.5m and a PCLS of 25% of £1.8m

Rules:

- An individual with enhanced protection, fixed protection 2012 or fixed protection 2014, but not primary protection, could elect for individual protection 2014

- Any existing enhanced protection, fixed protection 2012 or fixed protection 2014 takes precedence

- Maximum PCLS is 25% of the protected LTA

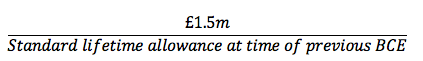

Where benefits were crystallised, or deemed to be crystallised, after 5 April 2006, but prior to 6 April 2014, the values at the time of the previous BCE (or deemed BCE) were adjusted by the following formula

EG – Eva, who is 70, is utilising the drawdown pension option having entered income withdrawal in November 2005. She had decided to elect for individual protection 2014 and her benefits were valued on 5 April 2014.

On 5 April 2014, the maximum pension income available to her was calculated as £42,000. Eva is only drawing an income of £20,000 p.a. She has not crystallised any further benefits since 6 April 2006.

For the purposes of individual protection Eva’s drawdown pension is valued at:

£42,000 × 25 = £1,050,000.

The actual amount that Eva is drawing is not used in this calculation and because there have been no BCEs since 6 April 2006 it is the value of £1,050,000 that is included in Eva’s individual protection relevant amount on 5 April 2014.

EG – Clive, who is 72, has a scheme pension that came into payment in 2004. His first BCE in respect of a personal pension fund took place in May 2010 when the lifetime allowance was £1.8 million and at that time his scheme pension was £15,000 p.a.

His pre-2006 scheme pension was valued for individual protection as follows:

- £15,000 × 25 = £375,000.

- The £375,000 was then revalued as:

Therefore, in respect of Clive’s scheme pension the value of £312,500 is included in his individual protection relevant amount on 5 April 2014.