- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Pension Credits

When a couple divorce there are 3 options of dealing with pension entitlements, one of them is pension sharing where the ex-spouse is entitled to a share of the former spouse’s pension:

- The entitlement received by the ex-spouse is a pension credit; and

- the loss in entitlement suffered by the member of the pension scheme is a pension debit

A member who had primary protection who gets divorced after 5th April 2006 may find it affects their protection and has to be re-calculated.

This is simply done by taking away the pension debit rights from the original benefit value on 5th April 2006 and using the lower value to recalculate the primary protection factor. If the reduced value of pension benefits falls below £1.5m the protection is lost.

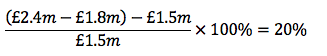

For example, previously Callum’s factor was 60% as his benefits were worth £2.4m on 5th April 2006. However he’s subject to a pension debit of £600,000 due to his divorce. Therefore his revised protection factor is:

A pension credit may also have an impact if the recipient (i.e. the ex-spouse) has enhanced protection. If so they may lose it as a result of receiving the pension credit. Whether or not this occurs depends on how the pension is received:

- if the pension credit is transferred into a new pension arrangement, enhanced protection is lost due to the setting up of the new arrangement, because the transfer of a pension credit is not a permitted transfer;

- if the pension credit is transferred into an existing money purchase arrangement enhanced protection is not lost, because the transfer is not deemed to be a relevant contribution; and

- if the pension credit is transferred into an existing defined benefit scheme or cash balance plan it is possible that enhanced protection may be lost at a later stage if relevant benefit accrual