- Who they can be paid to

- Uncrystalised or unused funds

- Defined Benefit Scheme

- Annuity

- Drawdown pension

- Trivial commutation

- Charity

- Guarantees

- Dependent’s scheme pension

- Survivor’s lifetime annuity

- Dependent’s capped drawdown

- Dependant’s, nominee’s or successor’s flexi-access drawdown

- Inheritance tax treatment

- Overview

- Primary Protection

- Enhanced Protection

- Fixed Protection 2012

- Fixed Protection 2014

- Fixed Protection 2016

- Individual Protection 2014

- Individual Protection 2016

- Pension Credits

- PCLS and Primary Protection

- PCLS and Enhanced Protection

- Scheme Specific PCLS Protection

- Transitional Protection and Auto Enrolment

Primary Protection

Primary protection could be used by individuals who had aggregate pension savings (including benefits in payment) of over £1.5 million as at 5 April 2006.

The main advantage of primary protection is that contributions can continue to be made, and/or benefits can continue to accrue, after A-Day.

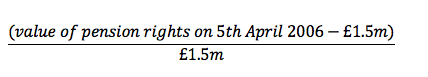

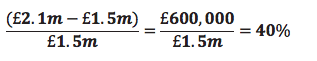

The first stage in the calculation is to work out a factor, known as the primary protection factor, which is effectively the percentage by which the benefits at A-Day exceeded £1.5 million (the lifetime allowance on 6 April 2006). The answer is rounded up to two decimal places.

Due to the rise and then subsequent fall in the LTA, any benefit crystalisation from the 2011/12 tax year the primary protection factor is applied to the highest LTA which is £1.8m. This will continue to be used until the LTA rises above £1.8m.

EG – Ben had aggregate benefits of £2.1 million on 5 April 2006 and therefore applied for primary protection. His primary protection factor was calculated as:

If he was to draw benefits in 2018/19 his primary protection factor will be applied to his underpinned lifetime allowance of £1.8 million.

Therefore, he would be entitled to a personal lifetime allowance of: £1.8m + (£1.8m × 40%) = £2.52m

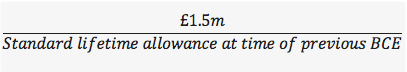

Benefits are likely to be taken at different times and so they’ll all be tested against the LTA each time. Any benefits previously taken will be taken into account when future BCEs take place. The amount used up at a previous BCE must be uprated by multiplying the value of benefits taken at the previous BCE by the following formula:

This formula offers substantial advantages where benefits crystallised in the earlier year were subject to a higher lifetime allowance than £1.5 million.

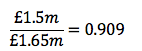

For example, if there was a BCE in 2008/09 the LTA was £1.65m. Therefore:

So a higher LTA at the point of a BCE will mean more LTA is left for future BCE