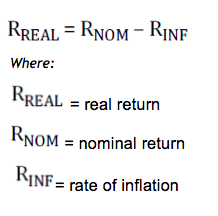

Real vs. Nominal Returns

The nominal return is the amount of return attributed to an asset purely on a numerical basis. However, we know that increased inflation reduces the purchasing power of any nominal value over time.

The real return adjusts for this.

An example:

If an investment has generated a rate of return of 9% over the last year where inflation was 2% for the same time scale, what is the approximate real return?

-First we know that the nominal return is 9 and the rate of inflation is 2:

-We then place these figures directly into the formula:

-Therefore the investment has generated an approximate real return of 7%

Question - Use Your Note Taker To Jot Down Ideas / Calculations

If an investment has generated a rate of return of 8% over the last year where inflation was 3% for

the same time scale, what is the approximate real return?

a) 4%

b) 6%

c) 5%

d) 4.5%

C)

Deduct the rate of inflation (3%) from the nominal rate of return (8%). This gives us a real rate of

return of 5%.

- Further Study Text: Pages 165