Return to Solo 7 (RO4) course

Reaching SPA on or after 6th April 2016

- individuals need a minimum of ten qualifying years (through contributions or credits) to receive any State Pension;

- the full rate of the new State Pension for 2018/19 is £164.35 per week and the Government has confirmed that this will increase in line with the triple lock until at least the end of this Parliament;

- to obtain a full new State Pension, individuals need at least 35 qualifying years (through contributions or credits);

- a higher pension may be payable if the individual has any entitlement to Additional State Pension (i.e. GRB, SERPS or S2P) accrued prior to 6 April 2016; and

- Class 1, 2 and 3 NICs all accrue new State Pension at the same rate.

- The full rate of the new State Pension will always be set at just above the basic level of means-tested support

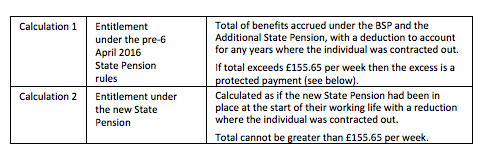

- Individuals who had not reached their SPA on 6 April 2016 had a foundation amount calculated. This was calculated as at 5 April 2016 and is the higher of the following two calculations.

- Where an individual’s foundation amount was calculated as being less than the full amount of the new State Pension in 2016/17, they are able to increase the new State Pension by adding more qualifying years to their NIC record between 6 April 2016 and their SPA.

- Where an individual’s foundation amount was higher than the full amount of the new State Pension in 2016/17, the difference is called their protected payment:

– when the individual reaches their SPA, their protected payment will be paid on top of the new State Pension; and

– the protected payment increases each year in line with increases in the

- In this case any qualifying years added after 5 April 2016 will not increase the individual’s State Pension entitlement.