Sharpe Ratio

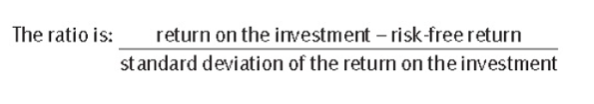

The Sharpe Ratio measures the excess return for every unit of risk taken.

Return = return on the investment being measured

Risk free return = return on a risk free asset, often considered to be Treasury Bills

Standard deviation = the volatility of an asset from the mean

Example:

An investment portfolio has an annualised return of 12%. Return on Treasury Bills over the same period is 3%. Standard deviation of the portfolio is measured as 10%. Calculate the Sharpe Ratio.

-First we know the values for the rates of return and standard deviation:

-We then place these figures into the formula:

-Therefore, Sharpe Ratio is 0.9. This indicates that for each unit of risk taken an additional 0.9% is earned on the portfolio relative to the risk free rate.

Questions - Use Your Note Taker To Jot Down Ideas / Calculations

- A fund manager generates a return of 12%, with the benchmark return being 11%. If the risk-free

return is 2.5% and the portfolio has a standard deviation of 7%, the Sharpe ratio is:

a) 1.36.

b) 1.79.

c) 2.

d) 2.20.

A)

Sharpe ratio = (the return on the portfolio – the risk free rate)/standard deviation on the portfolio.

So using the above figures (12%-2.5%)/7%=1.36

- Further Study Text: Pages 402 - 403